Helvetia Cadre Employee Benefit Scheme 1e. Shape your investments.

The Helvetia Cadre Employee Benefit Scheme 1e enables self-employed individuals and insured high-earners in a specific salary bracket to select the investment strategy for their retirement savings within the context of an occupational benefit scheme.

Our benefits for your managerial staff

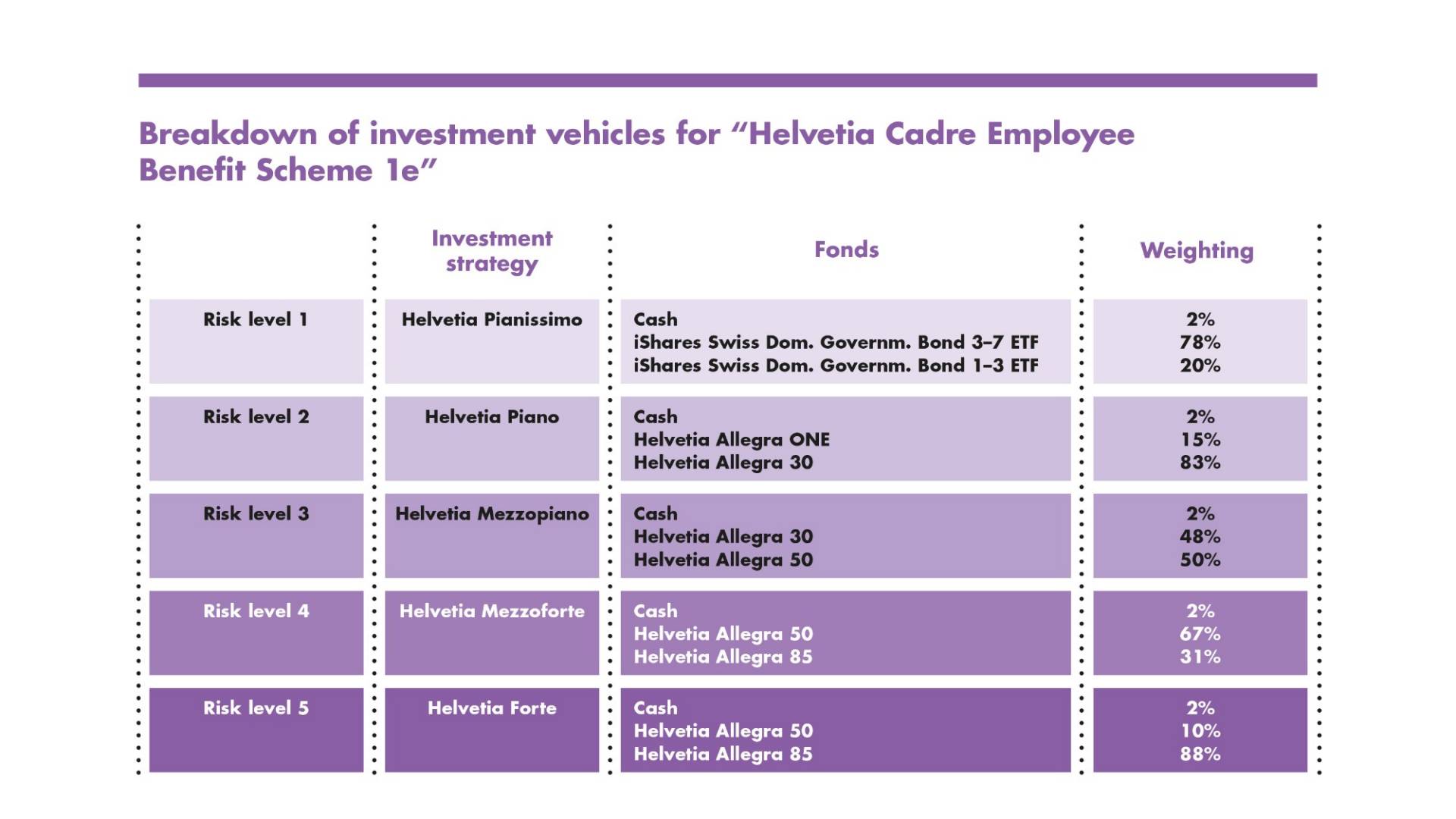

The company concludes a Helvetia Cadre Employee Benefit Scheme 1e policy. At present, every insured person can choose between five investment strategies, so they can select the strategy that best matches their risk preference and risk tolerance. The capital market risk is borne by the insured person.