Helvetia LOB Invest. The semi-autonomous employee benefit scheme with potential returns.

Pension solution with potential returns and more

When companies opt for Helvetia LOB Invest, they get an employee benefit scheme that combines state-of-the-art pension solutions with attractive potential returns and takes investment sustainability into account. It is suitable for companies that would prefer not to set up their own pension fund but nevertheless want to actively shape their employees’ pension arrangements.

Patria Cooperative, Helvetia's biggest shareholder, makes it possible for Helvetia LOB Invest to participate in its success via a voluntary contribution defined on an annual basis. In addition to the interest, persons insured with Helvetia LOB Invest benefit from this unique advantage.

By operating a progressive employee benefit scheme, you demonstrate that you take your social responsibility towards your employees seriously and boost your attractiveness as an employer. Self-employed people can also voluntarily join the insurance scheme set up for their employees.

With the relative application of the funding ratio, Helvetia LOB Invest, as a semi-autonomous group foundation, has developed an innovative protection mechanism. It kicks in if a company opts for an employee benefit solution with Helvetia LOB Invest and the foundation is underfunded prior to the contract taking effect.

Investment strategy and sustainability

The investment group pursues a balanced investment strategy that, in addition to current income, also aims to generate capital gains on equity investments – the strategic equity component is 35% and is broadly diversified. The strategic bond component amounts to 24% and, in addition to investments in the Swiss real estate market (26%) and in Swiss mortgages (10%), ensures the stability of the portfolio. A strategic component of 5% in alternative investments rounds off the investment group’s profile and, in addition to additional return opportunities, ensures a broad diversification of the asset classes.

Insured persons benefit from the positive development of investments as the additional interest supplements their retirement assets. Sustainable investments are also very important to us. For example, sustainability targets are integrated into the investment strategy, and also into the property strategies. A balance between returns, on the one hand, and environmental and social goals, on the other, is ensured, as well as long-term sustainability in relation to short-term profit maximization.

How flexible pension provision can be

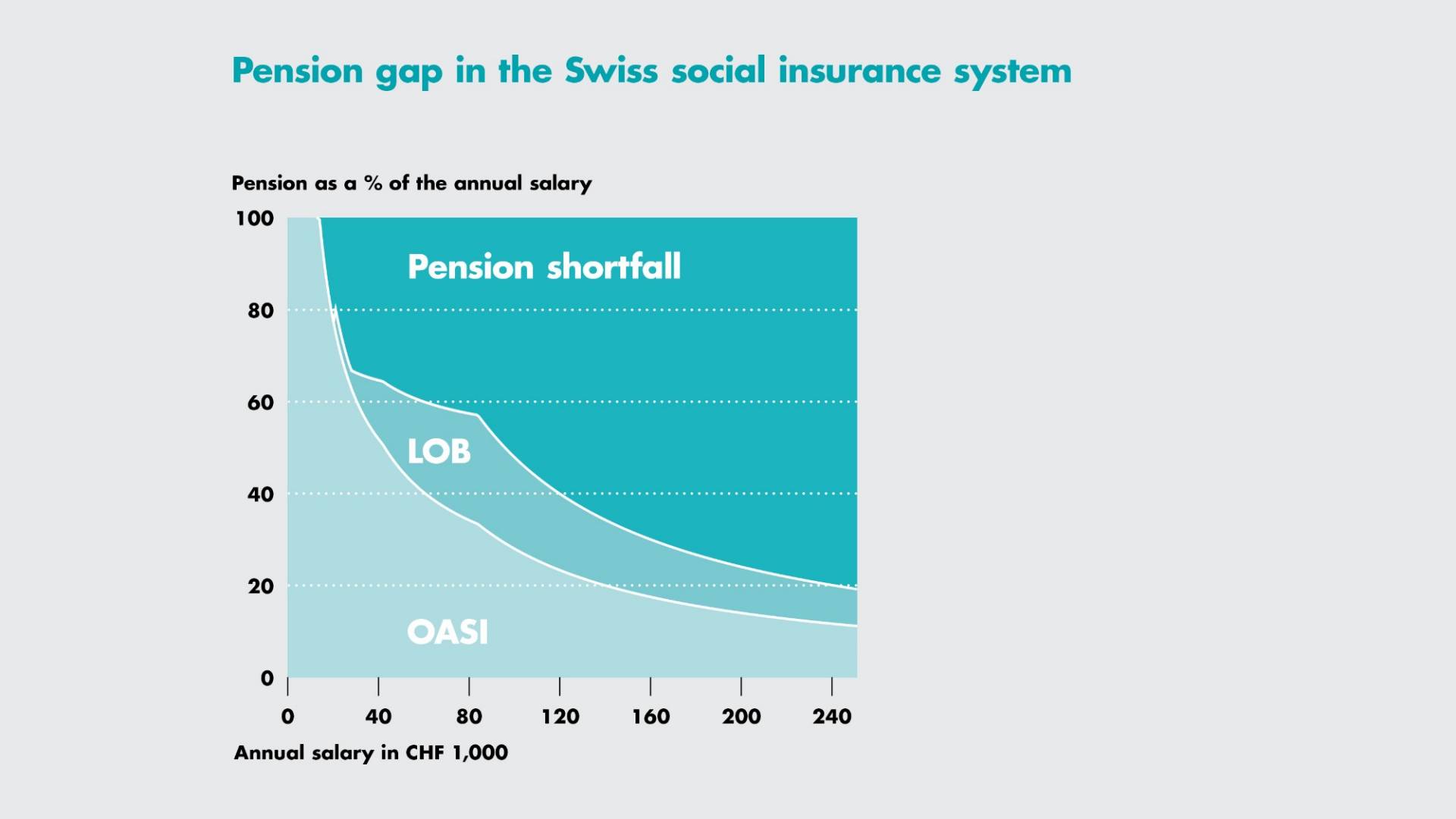

The basic pension scheme, which covers the mandatory part of the occupational benefit scheme in accordance with the Federal Act on Occupational Old-Age, Survivors’ and Disability Pension Provision (LOB), can be expanded as required by the company and its employees. Additional services without any extra costs are included with Helvetia. You have a lot of leeway in terms of designing your services.

Useful services around the clock

In addition to personal advice for your company and your employees from our specialists, useful tools are available for information and for the administration of your employee benefits. Helvetia is a pioneer in the digitalization of administration for the pension fund. This greatly reduces the workload and makes it easier.

| General regulation provisions |

| Supplementary Conditions Helvetia LOB Invest – Industry-specific early retirement solution |

| Supplementary Conditions Helvetia LOB Invest - Continued Insurance Art. 47a LOB |

| Partial liquidation rules |

| Investment rules |

| Sample contracts of association (The foundation instrument as well as the costs, organisation rules and election rules form an integral part of the contract of association) |