Helvetia cadre employee benefit scheme. Additional benefit coverage and greater flexibility.

Pension solution for specific requirements

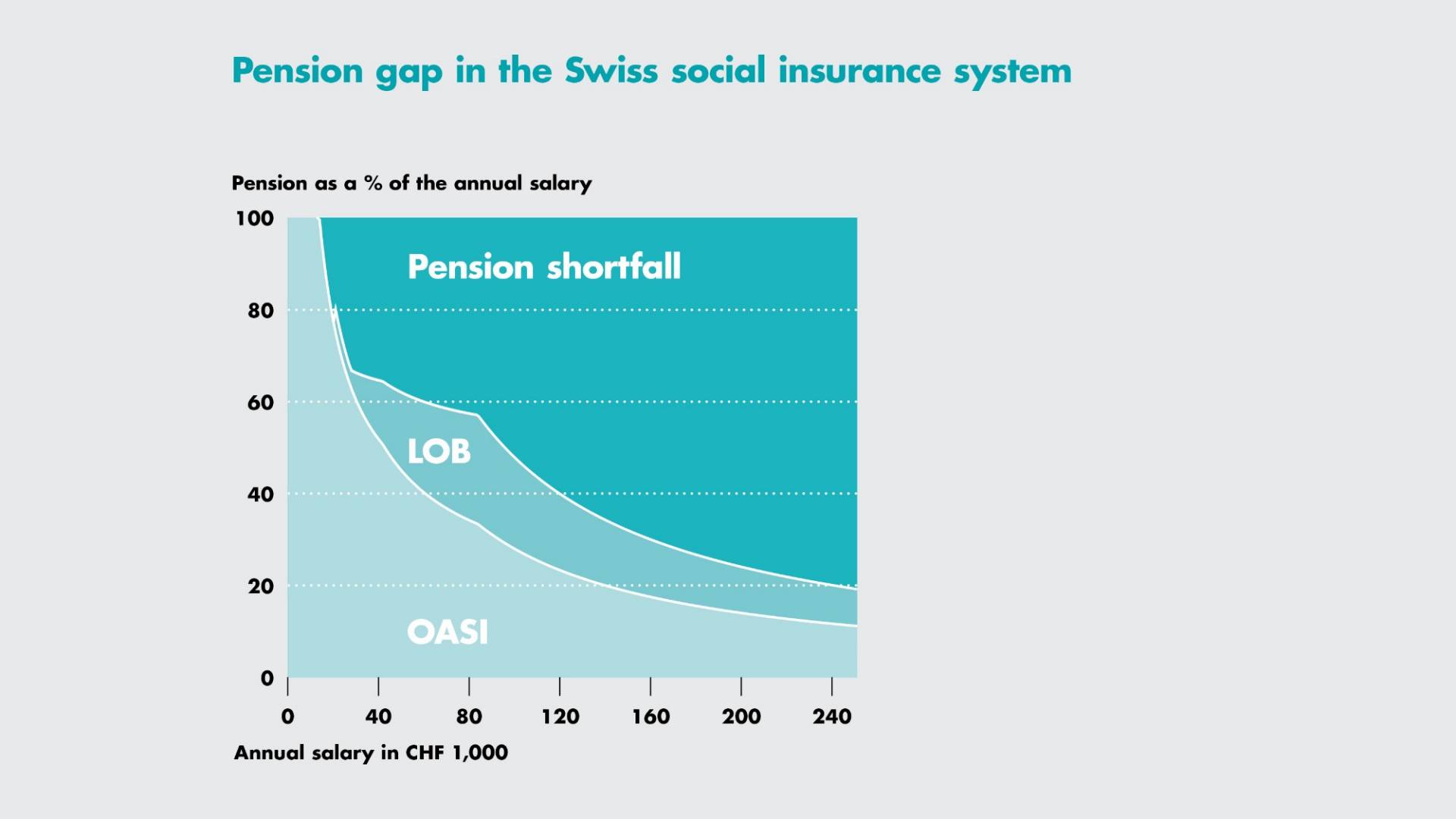

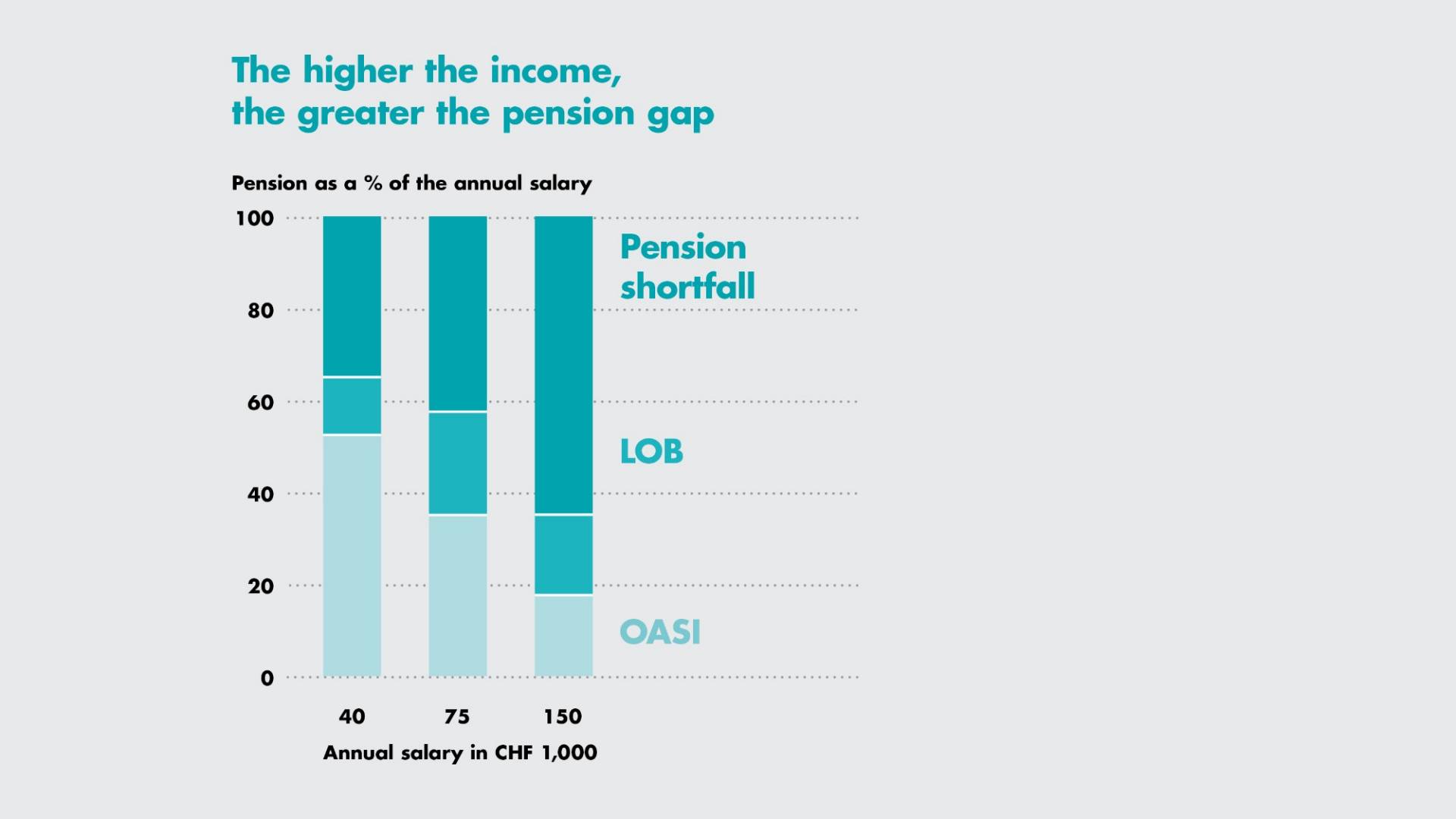

With the cadre employee benefit scheme, companies have the opportunity to improve the supplementary portion of the employee benefit scheme for certain employees, as required. In most cases, these are cadre employees who have significant shortfalls in their occupational benefits due to their higher salaries and who would like greater flexibility for their retirement benefits.

With this employee benefit solution, companies increase their attractiveness in the labour market. They thus strengthen the bond between their staff and the company, yet without having to manage their own pension fund. Company owners can also insure themselves and thus take advantage of additional benefits.

Pension model

Helvetia offers the cadre employee benefit scheme as full insurance. The existing basic pension scheme can be easily extended for certain groups of employees. Alternatively, you can decide to regulate the supplementary pension provision for your cadre employees in a separate cadre pension contract with Helvetia Prisma that purely provides supplementary benefits. Your basic and cadre benefit schemes are closely coordinated in both cases. The benefit schemes are flexible and tailored precisely to your needs.

Here you can find out more about the security of retirement savings and pensions with full insurance.

Investment strategy and sustainability

The pension assets of the insured persons are invested by Helvetia. In addition to the risks of death and disability, the investment risks and the longevity risk are also covered by an insurance contract. Among other things, the insurance thus provides the pension fund with a guarantee that the value of the retirement assets will be preserved as well as lifelong payment of the current old-age and survivors' pensions – regardless of developments on the financial markets.

In order to meet our responsibilities towards our stakeholders, we aim to manage all investments with sustainability risks and opportunities in mind, and we are committed to progressively moving our investment portfolio towards "net zero" emissions in accordance with the Paris Climate Agreement.

Useful services around the clock

In addition to personal advice for your company and your employees from our specialists, useful tools are available for information and for the administration of your employee benefits. Helvetia is a pioneer in the digitalization of administration for the pension fund. This greatly reduces the workload and makes it easier.

| General regulation provisions – occupational benefits with retirement capital |

| General regulation provisions – occupational benefits with retirement pension |

| Partial liquidation rules |

| Sample contract of association (The foundation instrument as well as the costs, organisation rules and election rules form an integral part of the contract of association) |