Helvetia full insurance. Risk-free employee benefits.

100% secure pension solution

With full insurance, companies receive secure employee benefits for their employees. Helvetia is one of the few providers of pension solutions where employers, employees and pensioners bear no risks. Because with full insurance Helvetia bears the investment market risks. Underfunding and thus restructuring contributions are excluded.

Full insurance is therefore suitable for all companies that do not have their own pension fund and are interested in a secure and professionally managed pension fund.

With this pension solution, you don't have to worry about the security of your pension assets and can focus on your company – especially in difficult times when it demands your full attention. Self-employed people can also voluntarily join the insurance scheme set up for their employees.

Investment strategy and sustainability

The pension assets of the insured persons are invested by Helvetia. In addition to the risks of death and disability, the investment risks and the longevity risk are also covered by an insurance contract. Among other things, the insurance thus provides the pension fund with a guarantee that the value of the retirement assets will be preserved, as well as guaranteeing the legally required minimum interest rate and lifelong payment of the current old-age and survivors' pensions – regardless of developments on the financial markets.

In order to meet our responsibilities towards our stakeholders, we aim to manage all investments with sustainability risks and opportunities in mind, and we are committed to progressively moving our investment portfolio towards "net zero" emissions in accordance with the Paris Climate Agreement.

How flexible pension provision can be

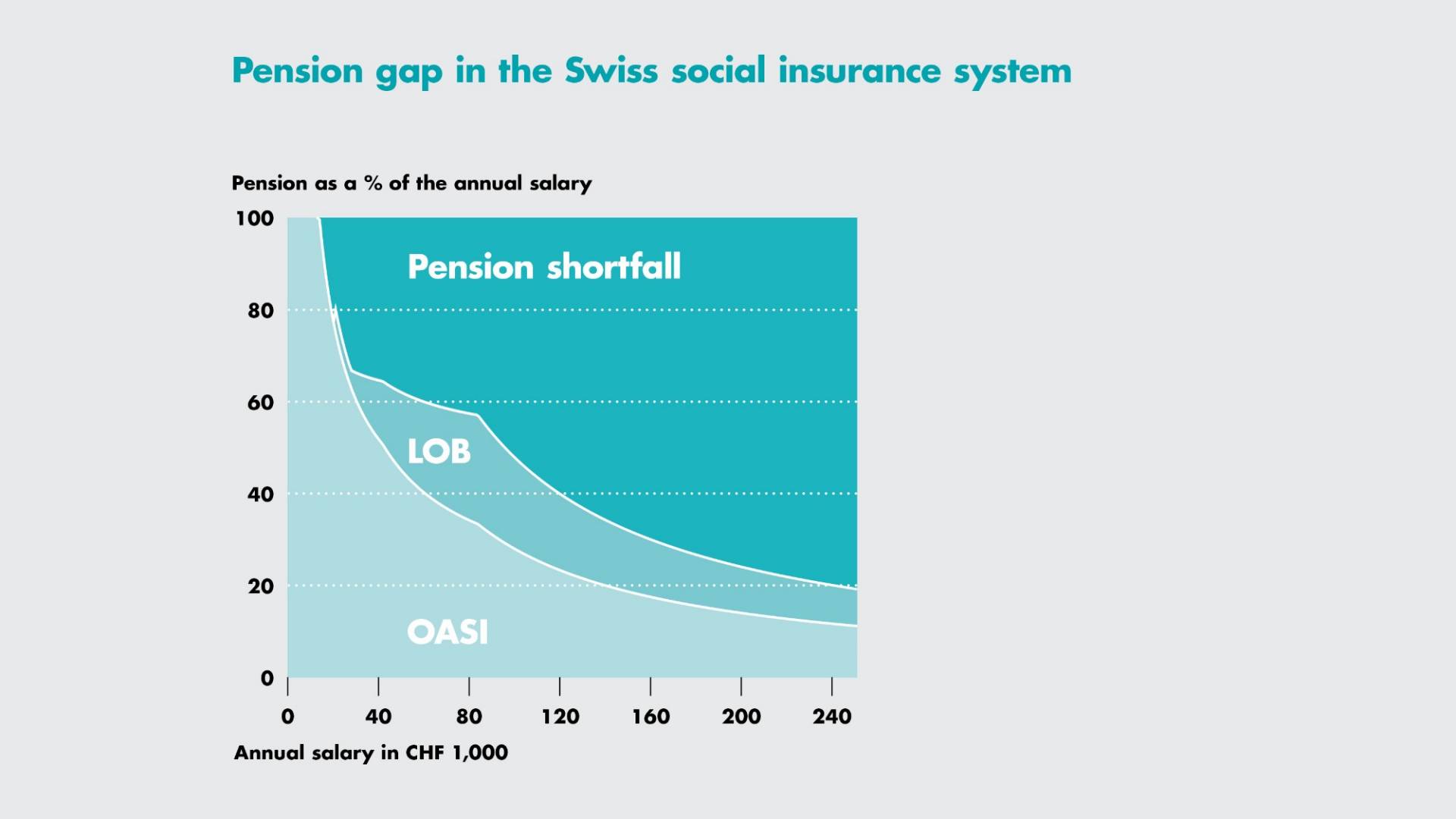

The basic pension scheme, which covers the mandatory part of the occupational benefit scheme in accordance with the Federal Act on Occupational Old-Age, Survivors’ and Disability Pension Provision (LOB), can be expanded as required by the company and its employees. Additional services without any extra costs are included with Helvetia. You have a lot of leeway in terms of designing your services.

Useful services around the clock

In addition to personal advice for your company and your employees from our specialists, useful tools are available for information and for the administration of your employee benefits. Helvetia is a pioneer in the digitalization of administration for the pension fund. This greatly reduces the workload and makes it easier.