Payment options

Note about occupational benefits: eBill is not yet offered for occupational benefits products.

Direct debit (DD)

When setting up a direct debit, you authorize your bank or PostFinance to debit your account directly and transfer the invoiced amount to Helvetia (payment authorization). You can object to any debit within 30 days.

We offer our private pension, mortgage and rental customers the option of paying regularly via direct debit.

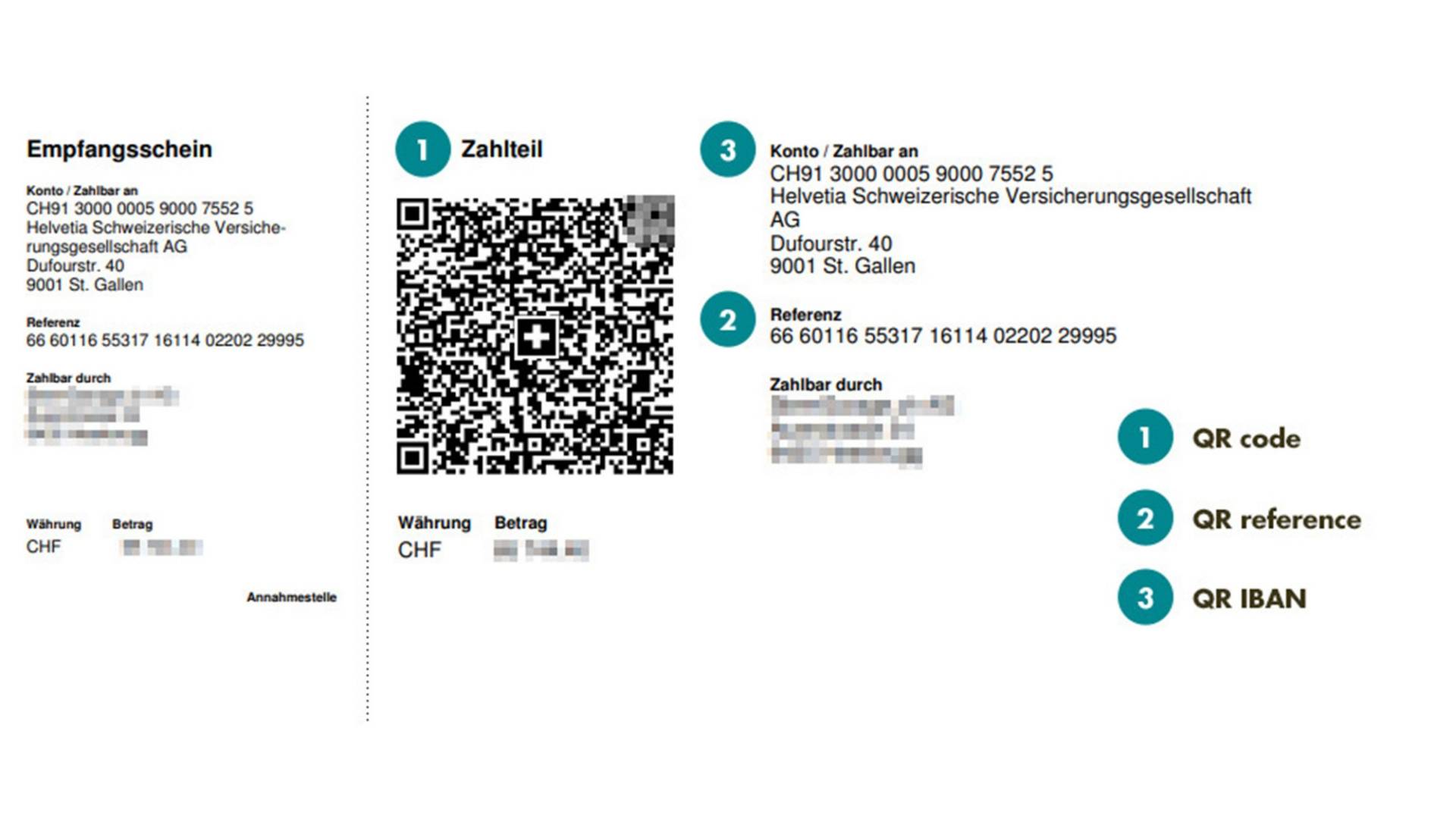

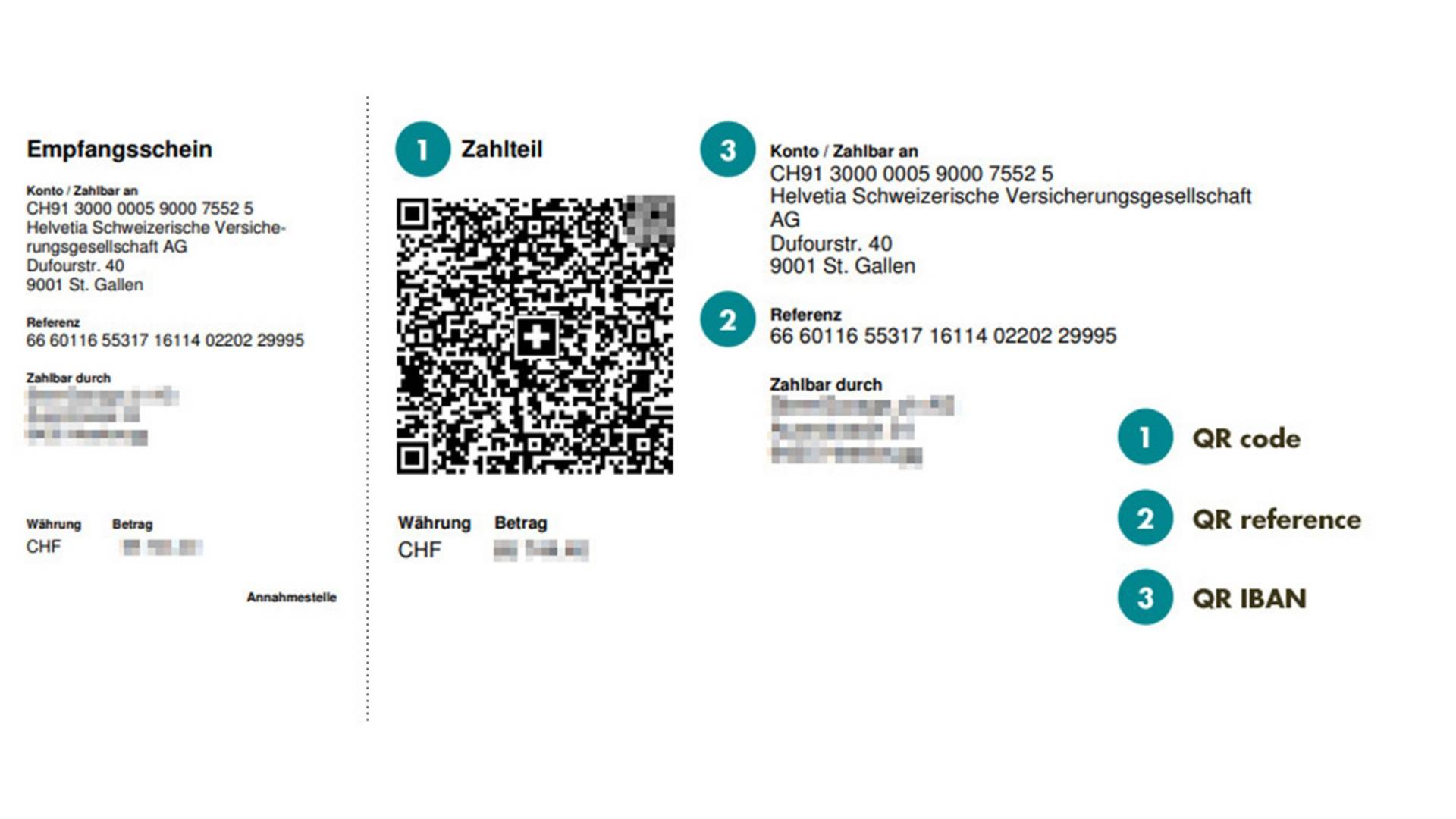

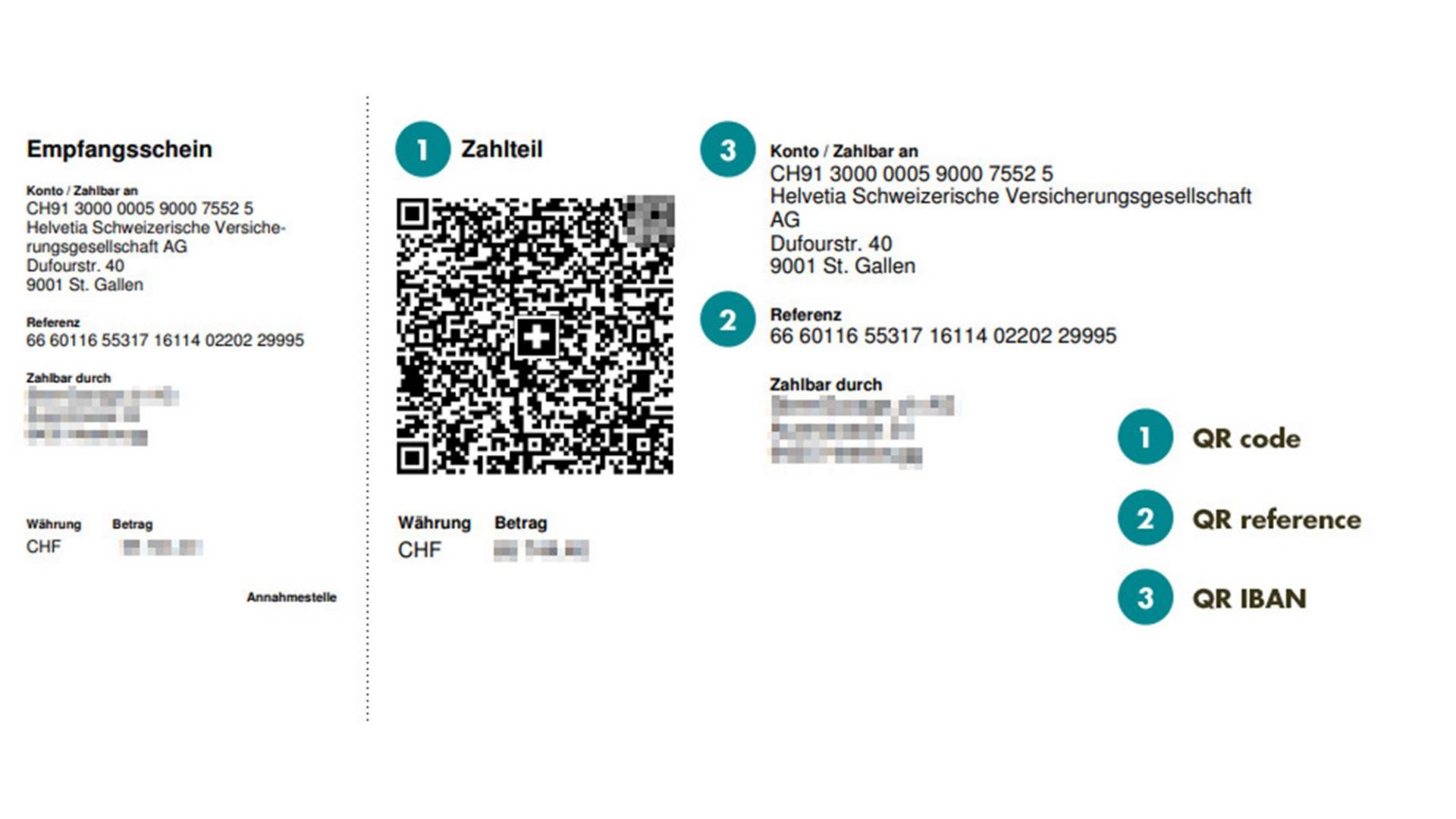

Payment slip/QR invoice

The practical QR invoice is replacing red and orange payment slips. These will no longer be in use after September 2022 following harmonization of Swiss payment transactions. Helvetia is also gradually switching to this new, efficient solution.