-

Paternity leave and reform of supplementary benefits

10.12.2020 | Priska SchnellSooner or later, societal changes are reflected in rules, laws and ordinances. Switzerland’s voters only just voted in September on paternity leave. After a lengthy parliamentary debate, the reform of supplementary benefits was approved by the Federal Council in January 2020. Both will now come into force. These are the new rules from 2021.

Paternity leave and reform of supplementary benefits

Two weeks paternity leave

Swiss voters endorsed paternity leave on 27 September 2020. The change in the law will come into force on 1 January 2021. Compensation for paternity leave will be financed via loss of earnings compensation (LEC).

An entitlement to two weeks’ paternity leave exists for a father who ...

- can prove that he was the child’s legal father at the time of birth, whether by marriage or by an acknowledgement of paternity, and

- at the time of the child’s birth was either an employee or self-employed or was receiving daily benefits as a result of unemployment, an illness or an accident, and

- in the nine months directly prior to the child’s birth was subject to compulsory OASI insurance and was working for at least five of those months.

No benefit is payable if the child is adopted.

The leave can be taken either in one block or by the day within six months of the child’s birth. As with maternity leave, the compensation amounts to 80% of the father’s average gross income prior to the birth, but no more than CHF 196/day. For this benefit the contribution to the loss of earnings compensation will be raised by 0.05 percentage points. The employer and employee each pay half.

Reform of supplementary benefits

The consultation procedure on the reform of supplementary benefits began in 2015. The aim was to optimize the supplementary benefits system and eliminate false incentives. A further goal was to basically retain the level of benefits and to afford better protection for the savings capital of compulsory occupational benefits. The change in the law will come into force on 1 January 2021.

The supplementary benefits reform is a targeted way of combating the rise in costs without reducing the level of benefits

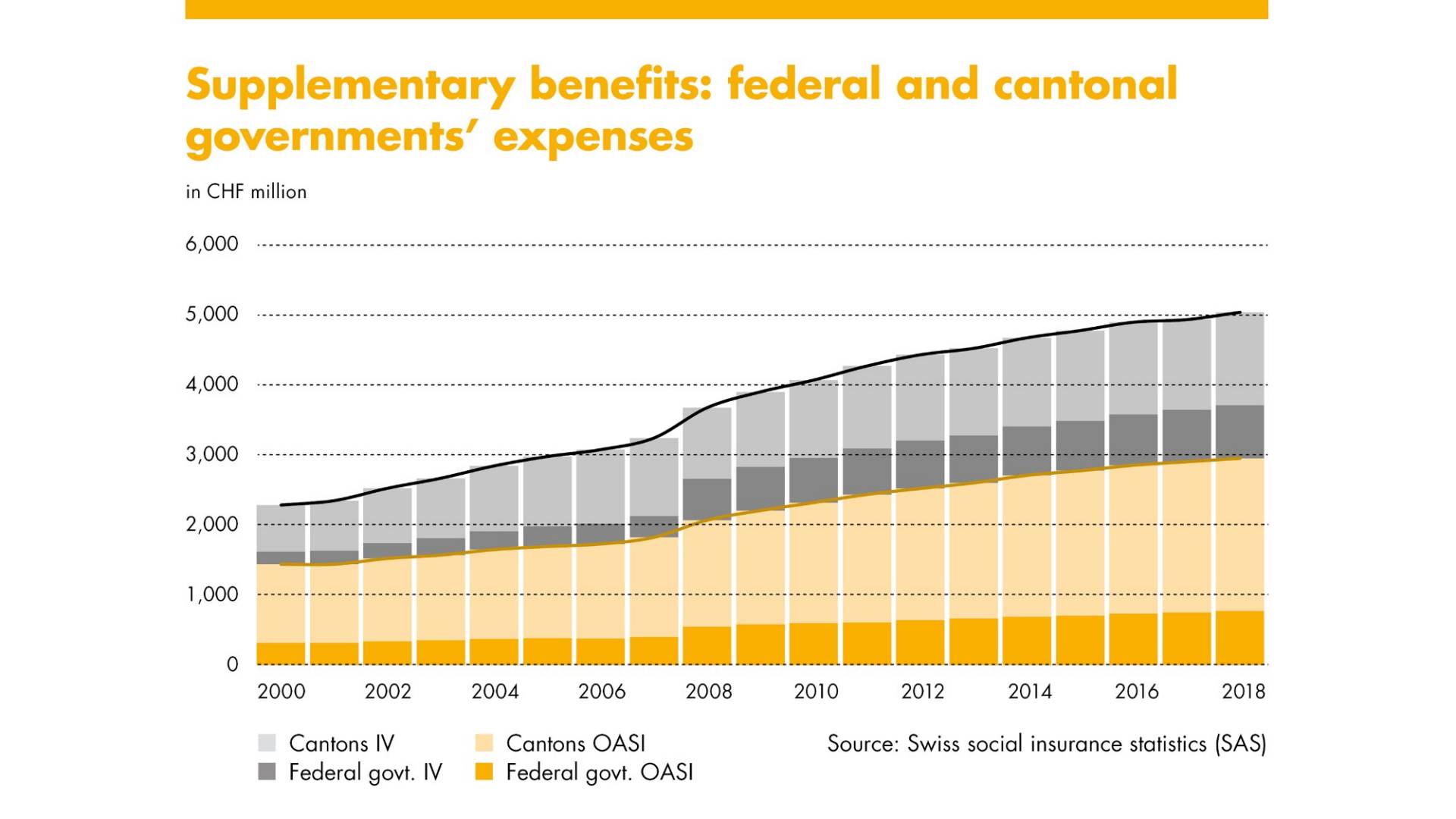

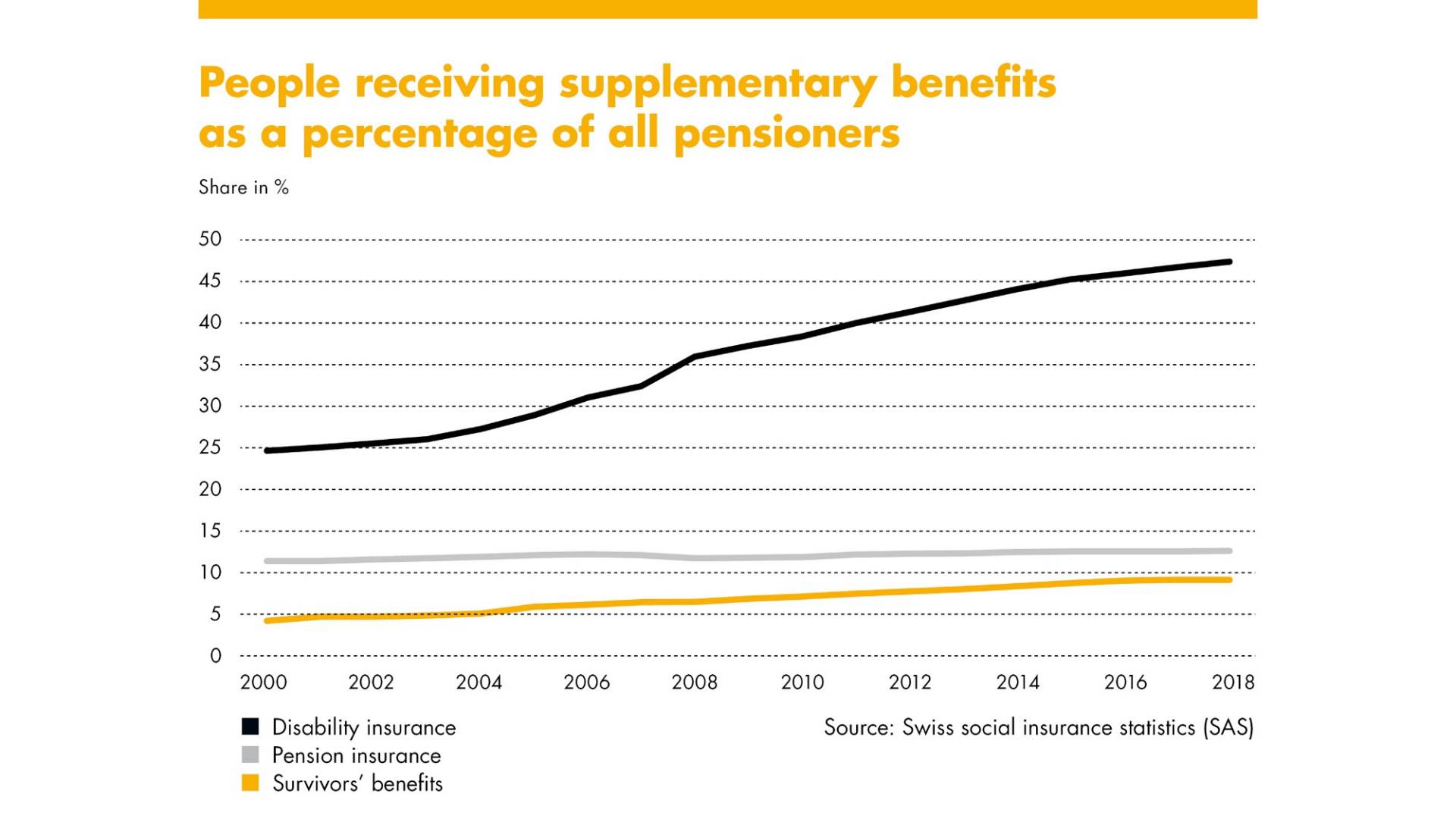

Swiss residents drawing an OASI pension or IV benefits can apply for supplementary benefits. Expenditure has more than doubled since 2000. Over the same period, the number of persons drawing supplementary benefits rose by over 60% to some 330,000.