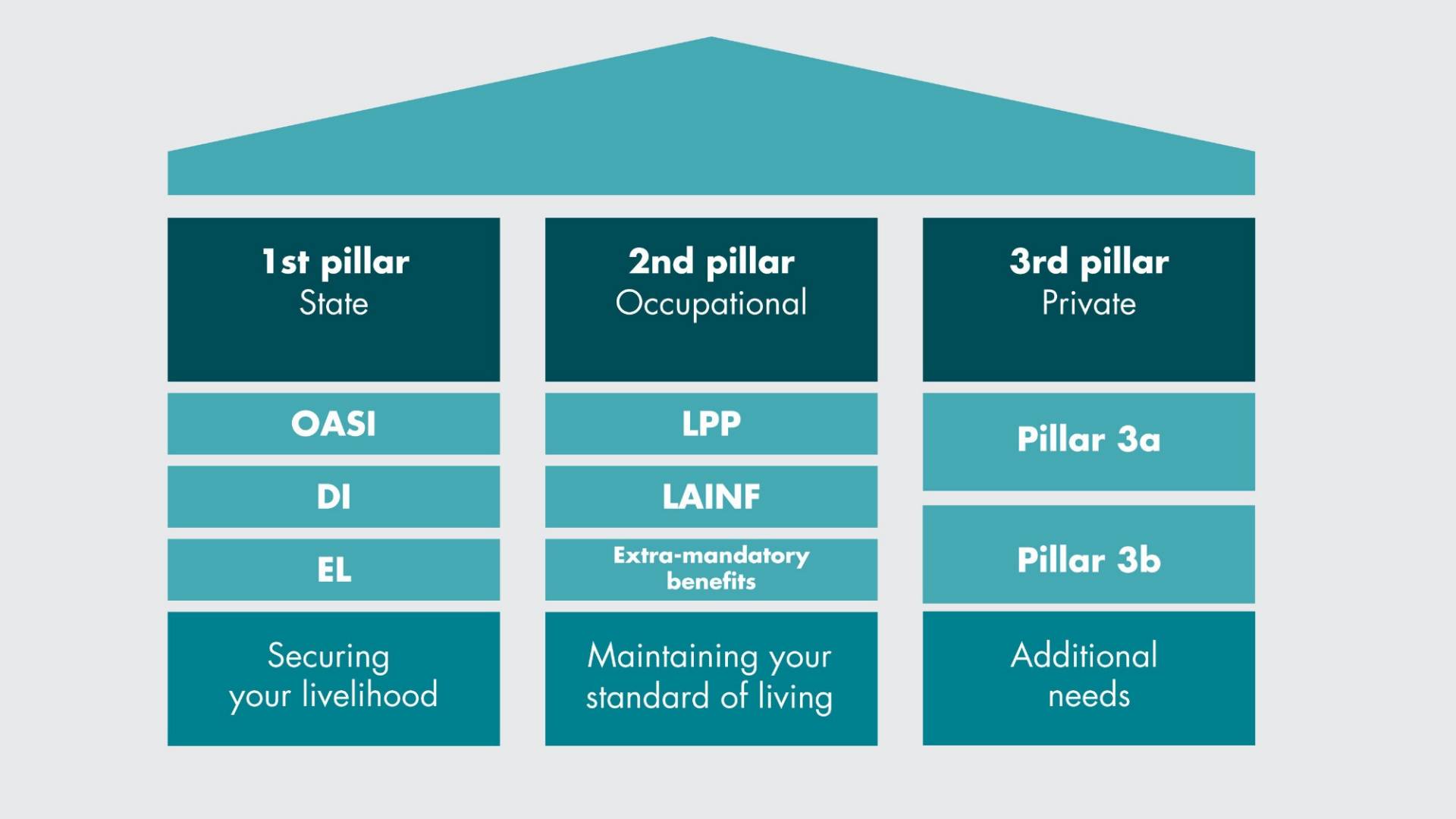

The three-pillar principle. How pension insurance in Switzerland works.

The Swiss pension system in a nutshell

The Swiss pension system is firmly anchored in the Swiss Constitution and in specific laws. The three-pillar principle is pivotal to the pension system. It comprises compulsory state and occupational pensions as well as voluntary private provision for retirement. These three pillars are closely coordinated, complement each other and provide financial benefits in the event of disability, retirement or death.

State pension: the first pillar

Everyone who lives or works in Switzerland is covered by the state old-age, survivors’ and disability insurance schemes (OASI/DI).

Employees’ contributions are deducted directly from their salaries. Those who are not gainfully employed must pay at least the minimum contribution, though the latter can be waived if their spouse pays at least double the minimum contribution.

Benefits are paid in the form of retirement, disability or survivors’ pensions. However, the maximum benefits are limited and also depend on how many years of contributions you have paid.

Occupational benefits: the second pillar

The Act on Occupational Old-Age, Survivors’ and Disability Benefit Plans (LOB) and the Act on Accident Insurance (AIA) regulate the cover all employees enjoy via their employers for occupational pensions (pension funds) and for occupational and non-occupational accidents.

The employees’ contributions are deducted directly from their salaries. The employer must pay at least the same contribution of their behalf. The employer must also pay the insurance contributions for occupational accidents.

Benefits are paid in the form of retirement, disability or survivors’ pensions. However, the maximum statutory benefits are limited and supplement the benefits paid under the first pillar.

Private pension provision: the 3rd pillar

Voluntary private pension provision (pillars 3a or 3b) allows everybody to supplement their first- and second-pillar benefits in line with their needs. The federal government offers tax incentives to encourage this additional form of pension insurance, especially tied pension provision (pillar 3a).

If you make voluntary provision for your retirement, you pay the contributions yourself. Under pillar 3a, these contributions can be deducted from your annual taxable income, up to the maximum amount set by the Federal Council.

Depending on your needs, the insurance can cover a variety of different benefits. The latter are paid out as capital benefits, retirement/disability pensions or death benefits.