-

Five tips for your property search

19.05.2022 | Melanie FreiDemand for residential property is high in Switzerland, while supply is limited. It is therefore often difficult to find your own house or apartment. Five tips for searching your future home.

Five tips for your property search

Set a budget

Your financial situation will of course influence your property search. The budget is based on your household income and your available equity. Our budget calculator will work out your price range.

Be flexible

Note down your requirements for your future home: How important is it to be near a station? Do you really need a fifth room? Note down what is negotiable and what is not. Avoid very specific wishes such as a lake view or south-facing balcony – there will be less chance of you missing out on attractive properties.

Confirmation of financing creates trust

After reviewing your personal documents, our partner MoneyPark will draw up a recognized confirmation of financing. You can enclose this when you make an offer on a property. A confirmation of financing creates trust and increases your chances when buying a property.

Look for properties online

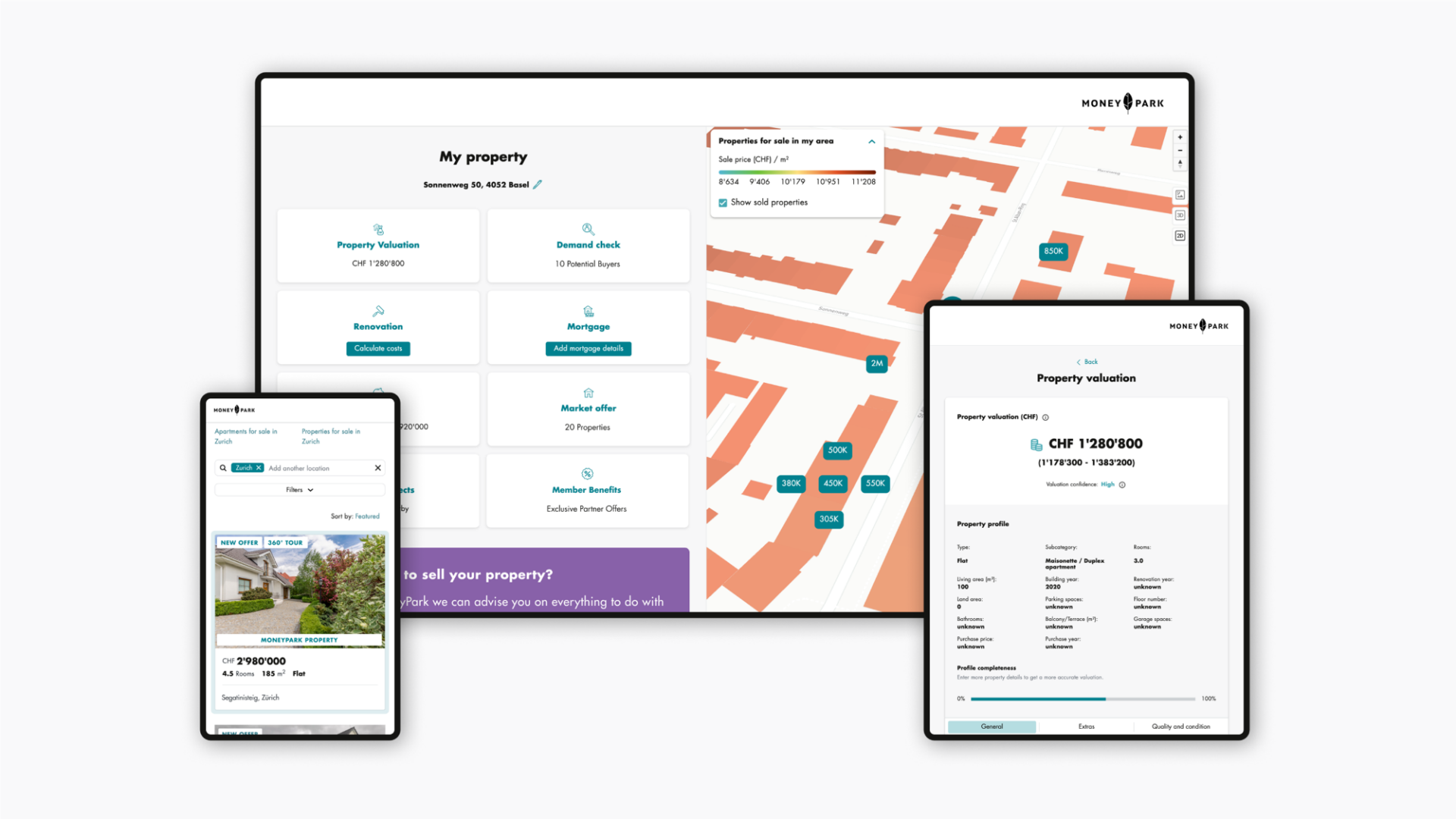

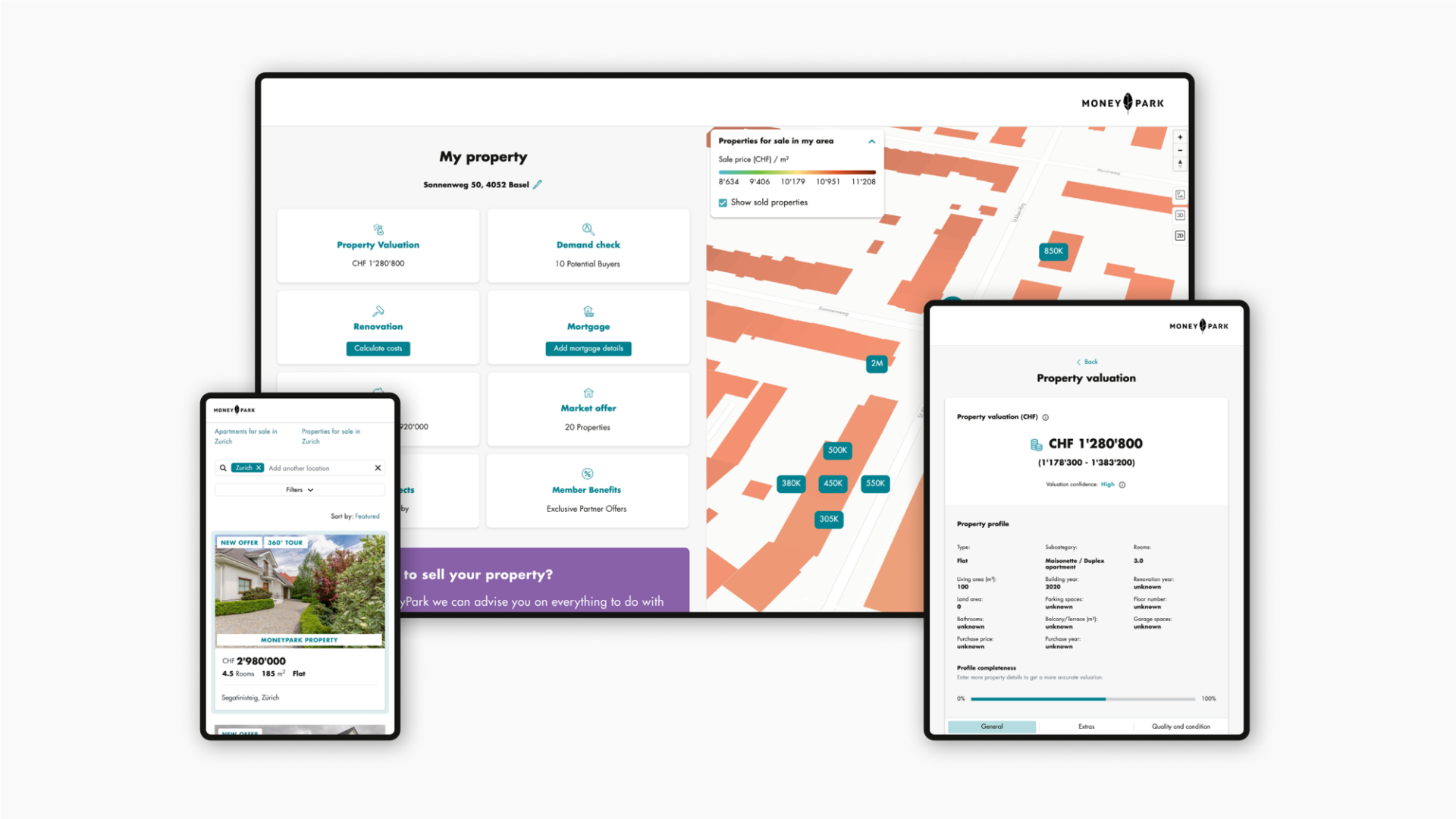

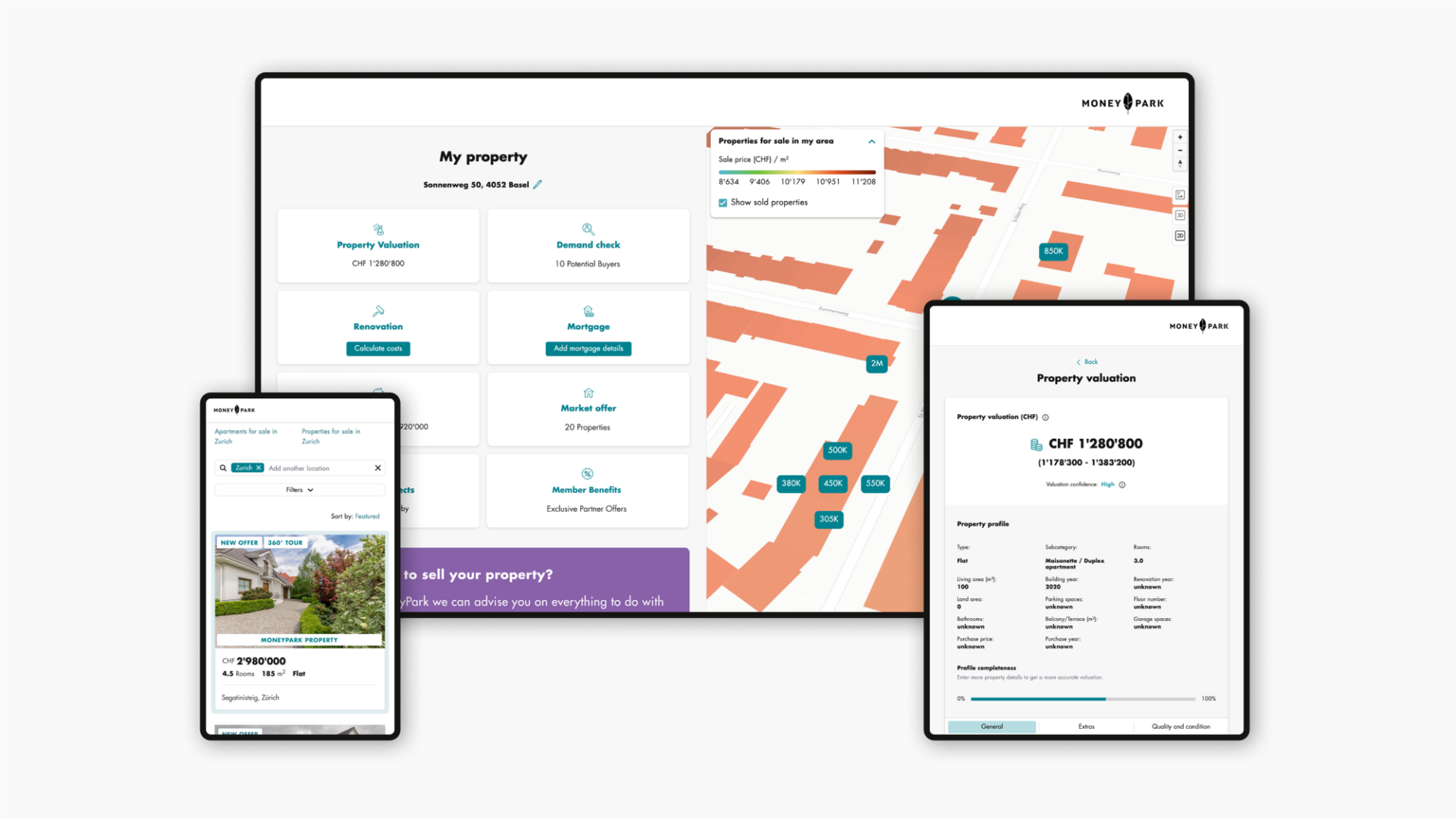

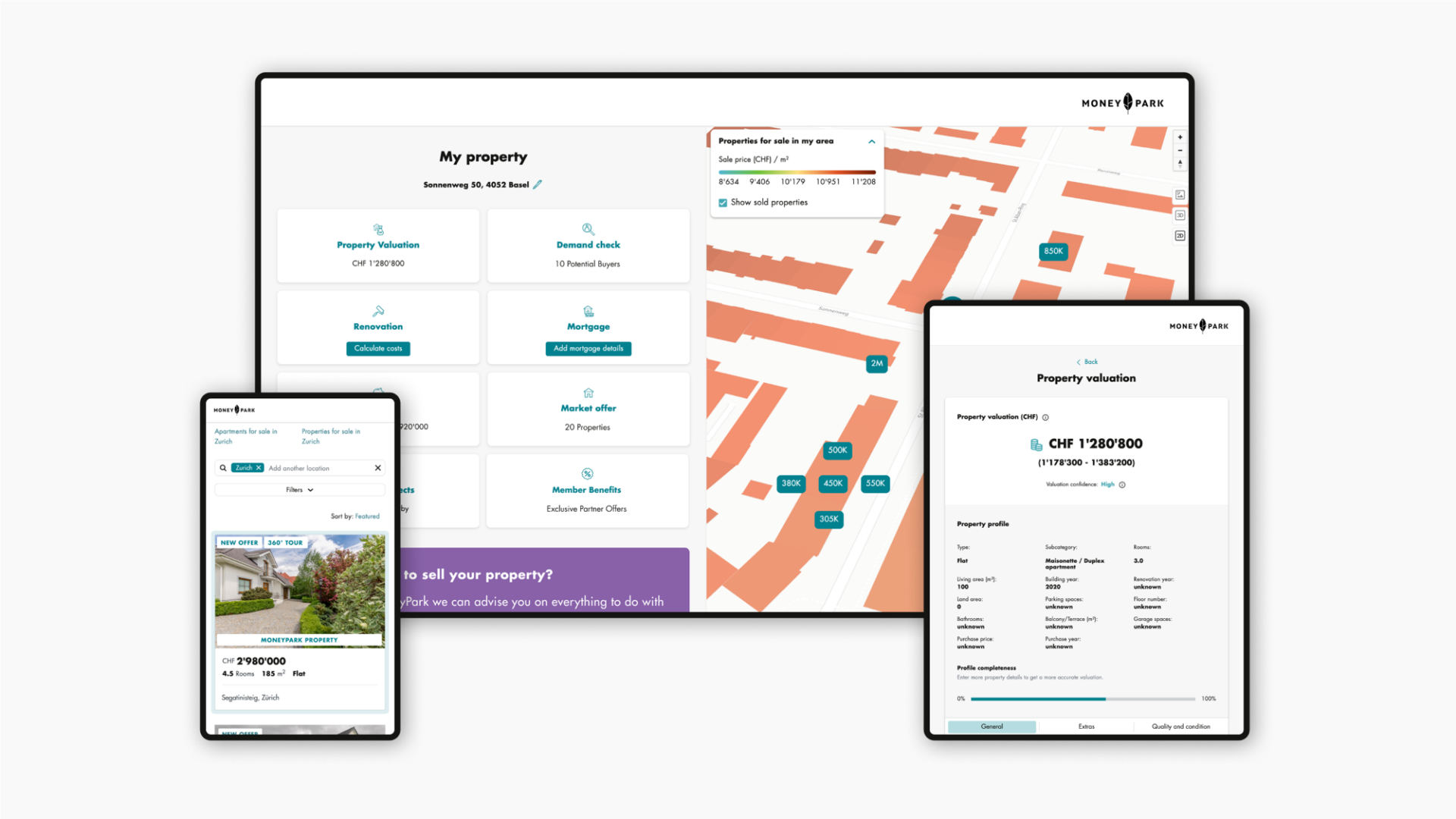

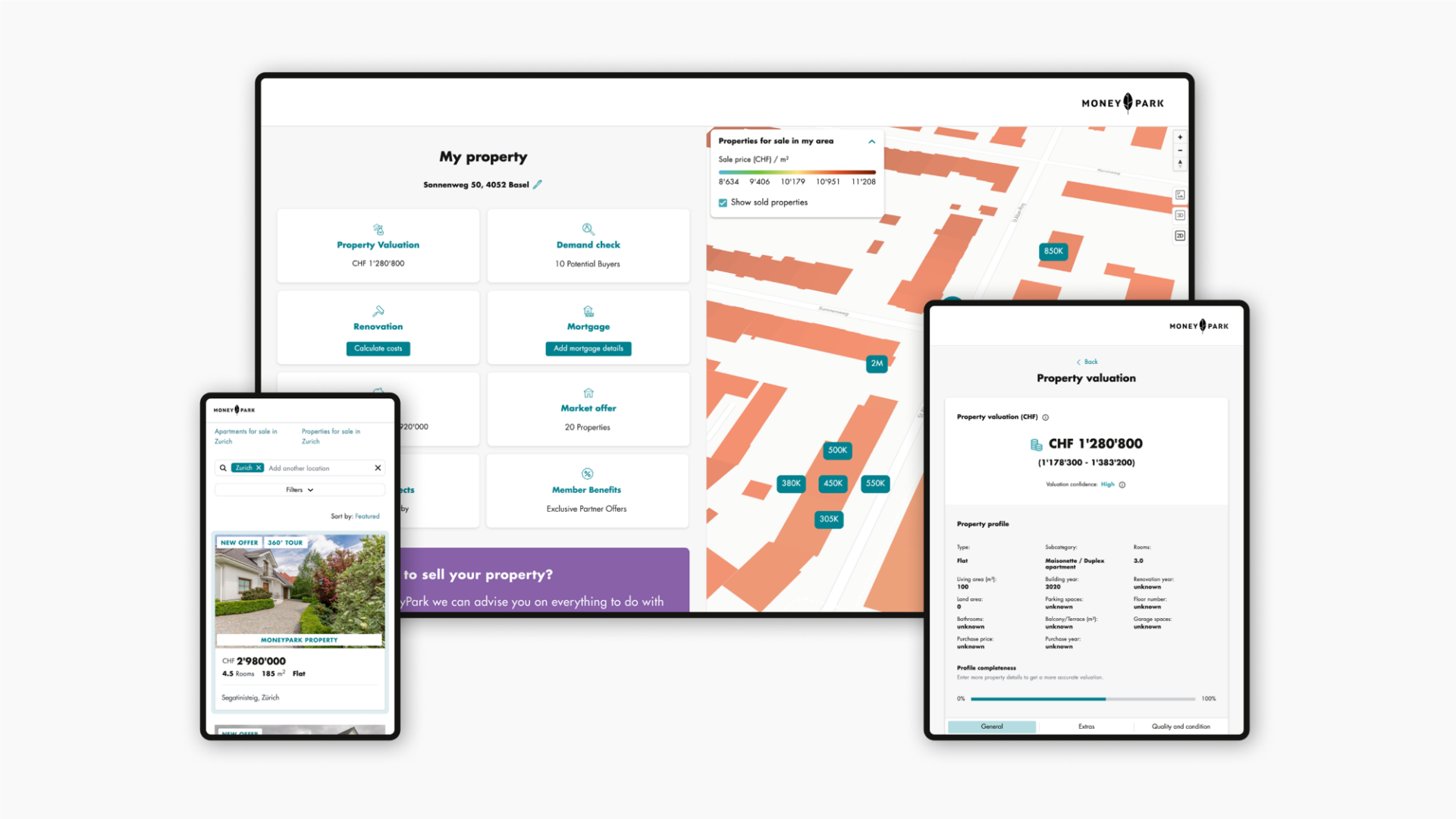

Looking on online portals is the easiest way to see a large number of offers quickly. The MoneyPark Cockpit is especially convenient, as it brings together advertisements from all the well-known property platforms. There are also houses and apartments that you will only find at MoneyPark. Our search function also provides information on the quality of the location: this includes details of the view, noise, schools or nearby shops.

Family, friends, estate agents

Don't limit your search to just the Internet. Include your neighbours, friends and relatives. Or put up a notice on your club’s noticeboard. Over the next few years, many baby boomers will be wanting to sell their houses due to their age – maybe someone can put you in touch? Approach estate agents: They may know people who will be selling their property soon.