"LOB 21" occupational benefits reform. An overview.

The objectives of the reform

The reform is intended to bolster the financing of the second pillar, maintain the overall level of benefits and improve the pension situation of employees with low salaries – often younger women and men or those in part-time employment.

The five core elements and their impact

If the reform enters into force, all elements described here will be implemented. As regards contributions and benefits, the effects on employees and employers will be very different. Whether or how someone was insured before the reform is a key question here. The personal situation of each person affected will also play a role in the assessment of their overall income and assets situation.

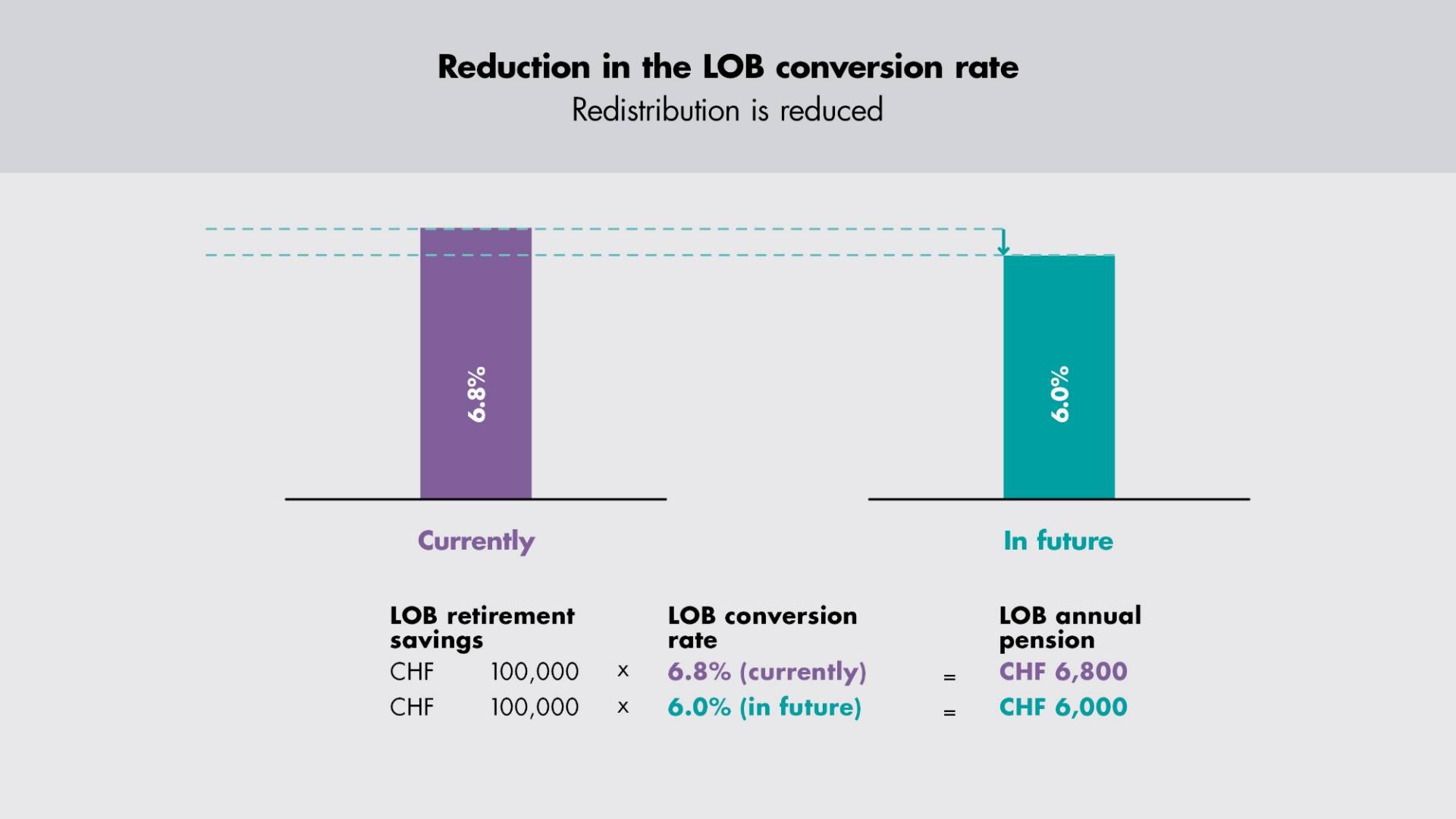

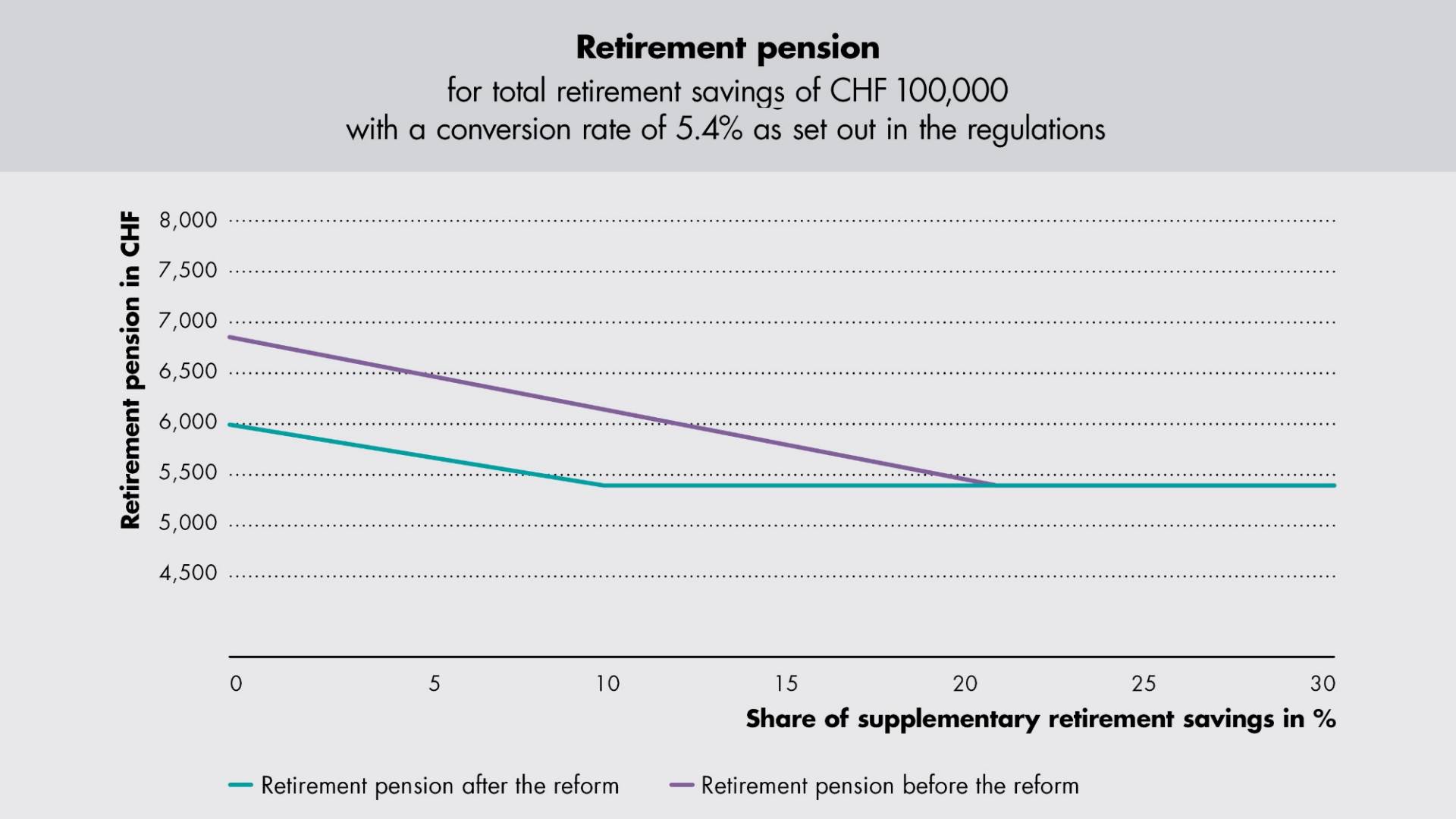

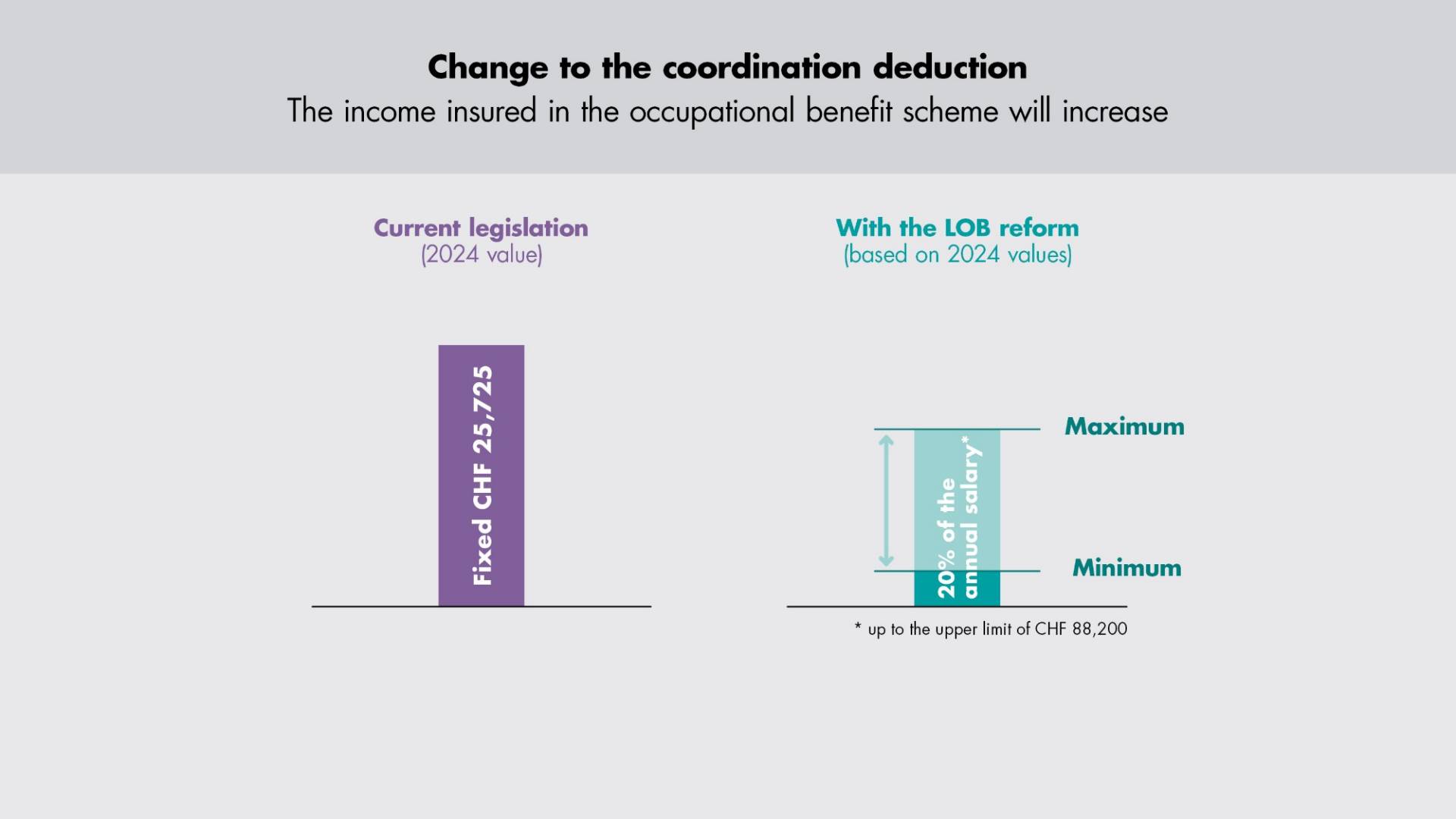

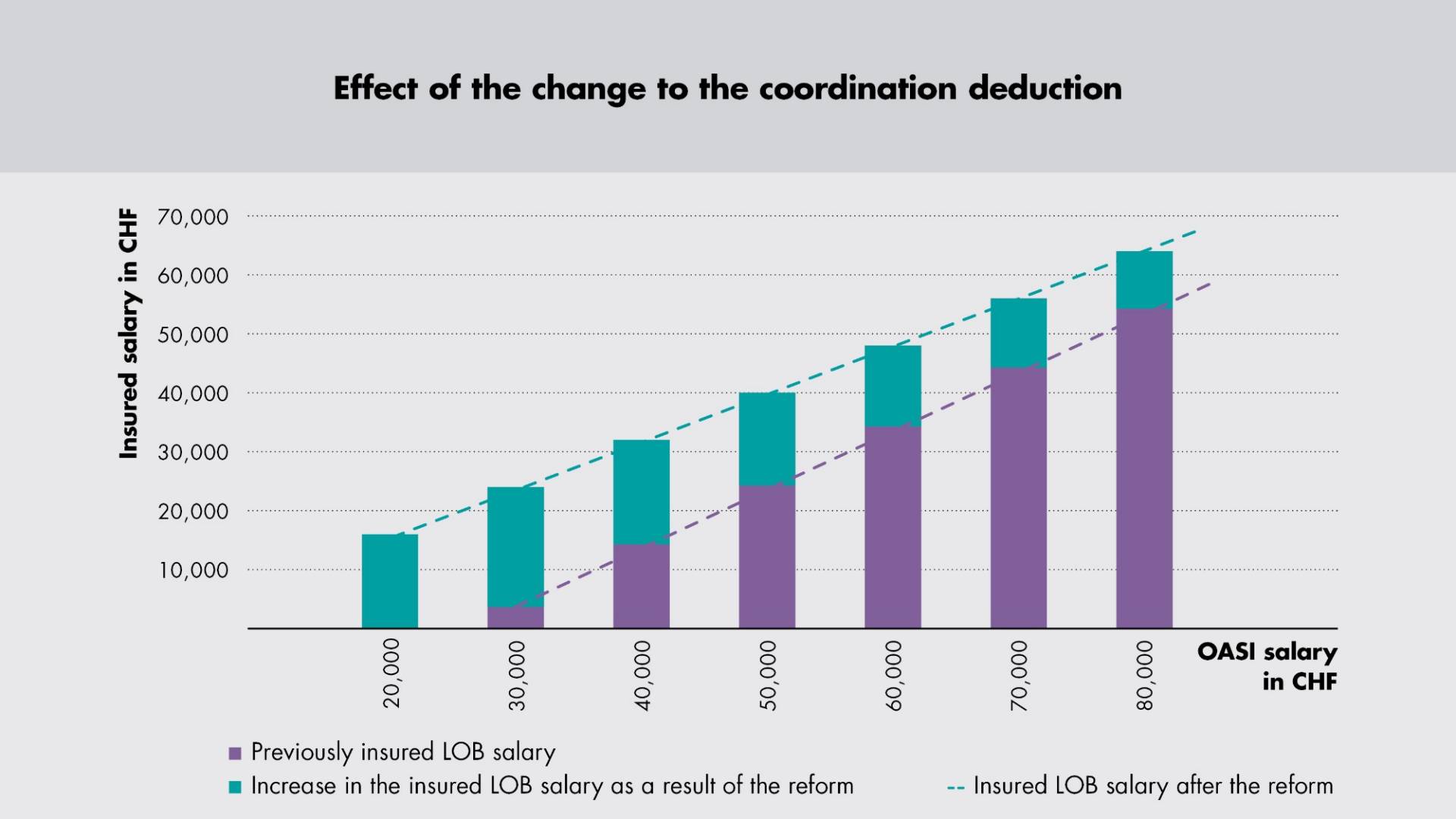

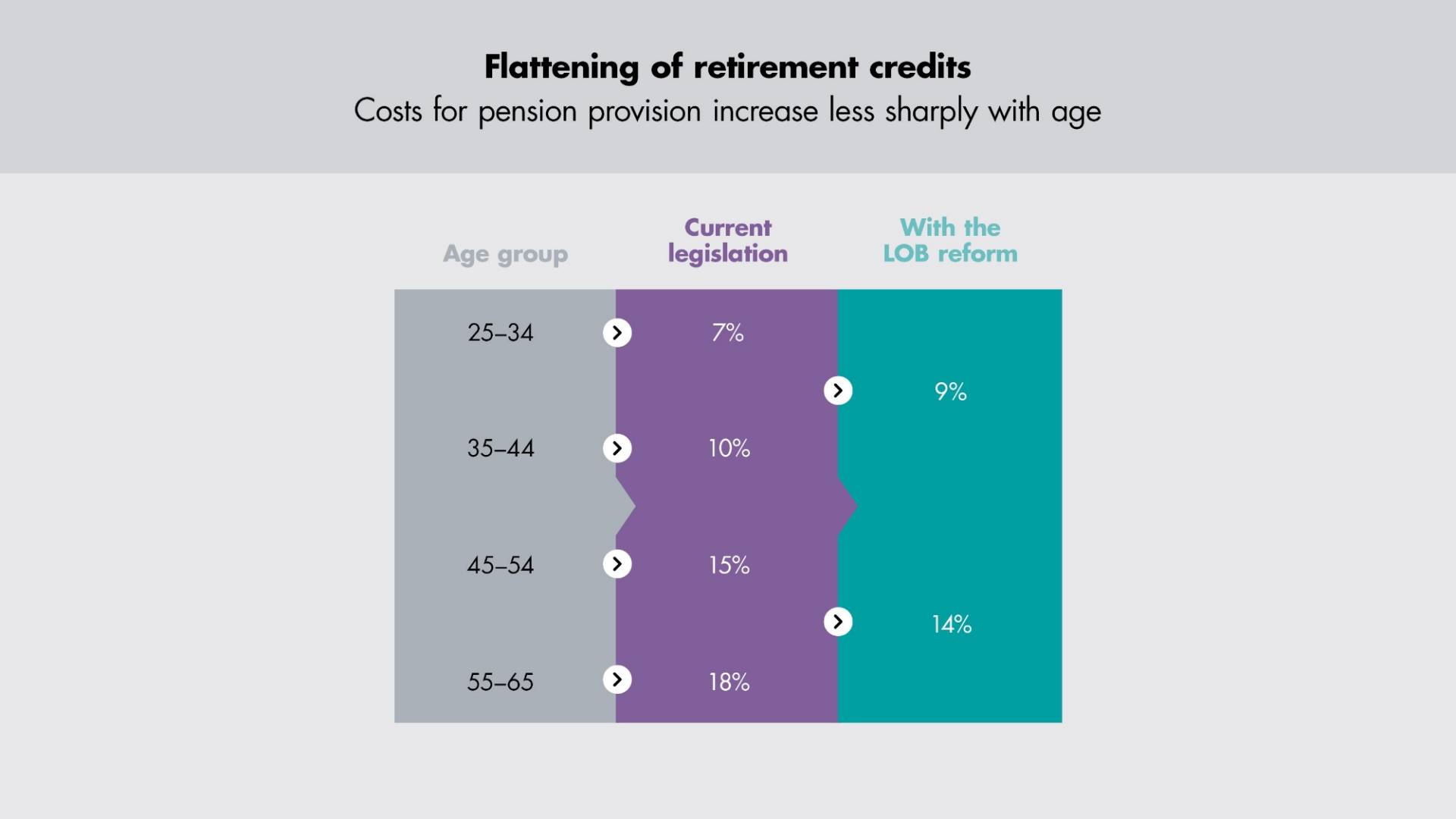

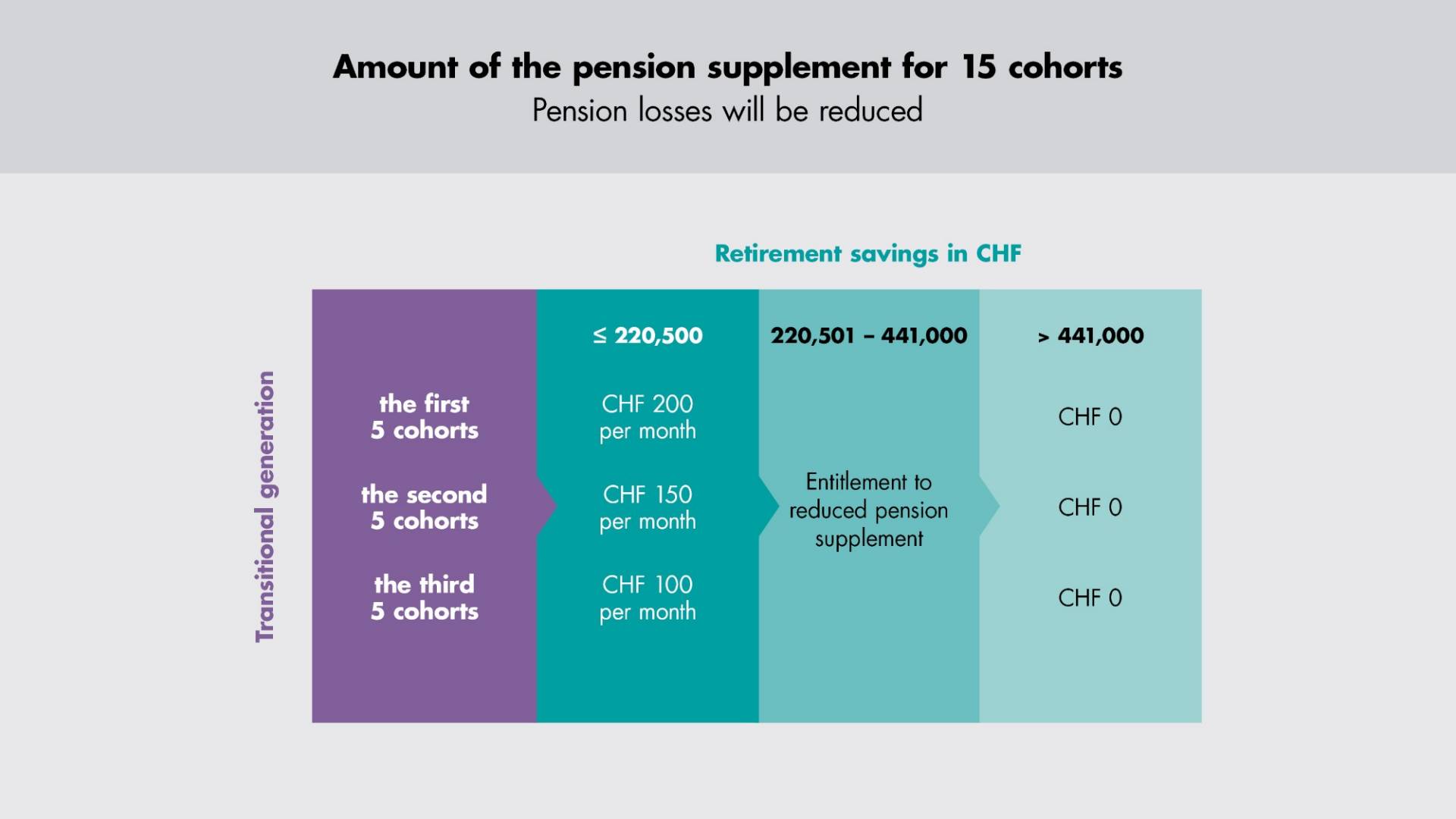

The reform includes lowering the LOB conversion rate from 6.8 percent to 6 percent, a measure intended to reduce the undesirable redistribution from active employees to (future) pensioners. At the same time, the savings process will be strengthened by adjusting the retirement credits and the coordination deduction and by providing for pension supplements for the "transitional generation", the aim being to largely maintain the existing level of benefits. Lowering the entrance threshold and increasing the insured salary will improve the pension situation of employees with low salaries – often younger women and men or those in part-time employment.